Best Financial Services Offshoring in India for BFSI Team & Infra Expansion

Access Indian BFSI talent, infrastructure, and advisory through financial services offshoring for cost-efficient banking and financial operations.

BFSI Challenges Driving the Need for Offshoring

Global BFSI enterprises face multiple challenges while hiring talent, driven by cost pressures, skill shortages, and rising digital demands.

Cybersecurity Failures

BFSI firms face rising threats, straining in-house protection capacity.

Customer Experience

Digital-first consumers expect seamless, always-available financial services.

Digital Skills Gap

Institutions struggle to find qualified talent for financial analysis.

Operating Costs

Escalating expenses impact BFSI profitability and scalability targets.

Legacy System

Outdated platforms consume budgets and limit modernization initiatives.

Fintech Competition

Traditional BFSI firms lose ground to agile fintech entrants.

Why Choose Momentum91 for Your BFSI Offshoring?

Momentum91 delivers financial services offshoring with Indian top talent, infrastructure, and advisory for BFSI banking, accounting, research, and insurance.

300+

Clients served across industries with dedicated offshore development teams and technology solutions.

70+

Experts added with 7+ years experience providing expertise across multiple technology stacks and platforms.

94%

Client satisfaction rate demonstrating consistent quality and long-term partnership success.

BFSI-Focused Offshoring Solutions

We provide offshoring services to deliver talent, infrastructure, and advisory for banking, accounting, research, and insurance.

Set up offshore teams in India for mobile banking and payment solutions with expert support across infrastructure and advisory.

Leverage Indian professionals for offshore financial analysis and investment research, delivering insights that drive BFSI efficiency.

BFSI offshoring services streamline offshore insurance claims processing and policy management with dedicated Indian talent and infrastructure.

Access offshore fund administration in India with transparent operations, scalable infra, and advisory for BFSI shared services.

.avif)

A plethora of insights,all in one place

From strategy to execution. All the big ideas, practical guides & fresh perspectives that’ll help you scale with confidence

Ebooks

Comprehensive guides that break down the shifts in business and technology, Helping you lead with clarity.

Office Hours

Your direct line to our experts. Practical advice for scaling, right when you need it.

Reports

Data-backed perspectives on where industries are headed, giving you the foresight to make bolder moves.

Newsletter

A quick catch-up with ideas, wins, and tips worth stealing, straight to your inbox every week.

.avif)

Podcasts

Conversations where you get to know everything from the ones who know it best.

.avif)

Got Questions? We’ve Got You Covered.

We follow strict data-security controls, role-based access, and NDA-backed operations while delivering financial services offshoring. Our BFSI offshoring services align with global standards so offshore banking support and other functions never compromise sensitive customer information.

Offshore banking support works well for KYC reviews, account maintenance, loan processing, reconciliations, and customer query back-office tasks. By moving these repeatable processes to India, you free onshore teams to focus on relationship management and higher-value financial services offshoring work.

Yes, we set up offshore accounting services that handle multi-entity general ledgers, reconciliations, payables, receivables, and month-end close. Centralizing these activities under BFSI shared services in India improves accuracy, reduces close times, and brings predictable costs across all entities.

Offshore financial analysis specialists in India prepare management reports, variance analysis, and profitability insights for different BFSI business lines. Combined with offshore investment research, this gives leadership faster, data-backed decisions without expanding expensive onshore headcount.

We can run equity, credit, and market research, build financial models, and maintain investment dashboards as part of our financial services offshoring model. These offshore investment research teams plug into your existing workflows and comply with your internal review and approval standards.

Our BFSI offshoring services set up specialist pods for policy issuance, endorsements, renewals, and endorsements review. Offshore insurance process management teams follow insurer playbooks, SLAs, and compliance rules so underwriters and brokers receive clean, ready-to-act files.

Yes, we build scalable teams in India for offshore claims processing, covering first notice of loss (FNOL), document checks, adjudication support, and payout coordination. This reduces backlogs, shortens cycle times, and gives your policyholders faster, more transparent claims resolutions.

We offer offshore fund administration as part of our financial services offshoring in India, managing NAV calculations, investor reporting, reconciliations, and compliance checks. This allows asset managers and funds to scale operations cost-effectively while maintaining strong governance and audit readiness.

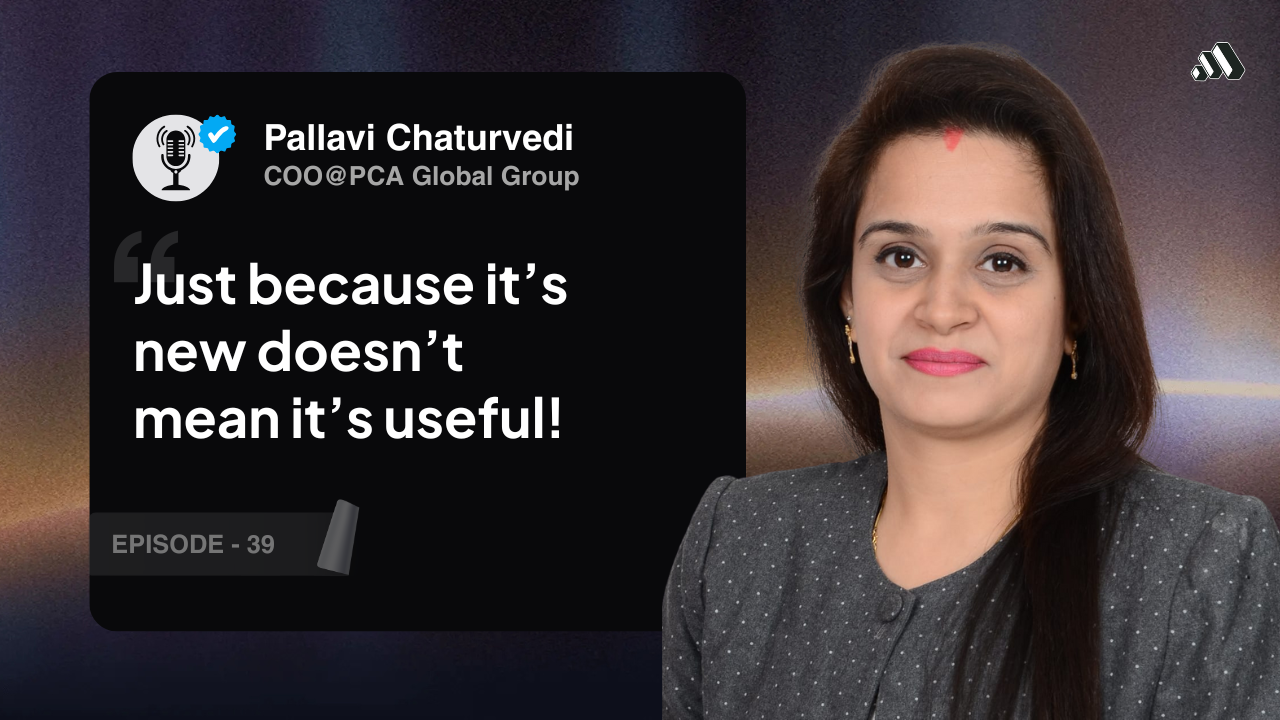

Interesting Conversations with Ambitious Leaders

Lorem ipsum dolor sit amet consectetur. Scelerisque tincidunt nisl ipsum tellus. Nunc egestas maecenas pulvinar rutrum ut nunc malesuada leo urna. Lacus nullam

Hire Offshore Developers, Right Now!

Access top-tier global talent, enterprise infrastructure, and complete regulatory compliance through our proven model.

Build your team

.avif)